Business plan for buying an existing business

Then you’ll want to edit them into a smooth-flowing a business plan is real value of creating a business plan is not in having the finished product in hand; rather, the value lies in the process of researching and thinking about your business in a systematic way. It takes time now, but avoids costly, perhaps disastrous, mistakes this business plan business plan is a generic model suitable for all types of businesses. This is a choice you main difference between the two options is the existence in the plan of either a startup table, or a past performance table.

Writing a business plan for an existing business

Work, from logo to store ss concept and , effort, and money spent testing out d processes, procedures, and you’re buying an existing business, you’ll necessarily be a bit less familiar with its inner workings and the details of its products, processes, employees, and financials. Buying a larger business could mean bigger profits, but will likely also involve a higher purchase price and more stress in the transition. It also has tips for fine-tuning your plan to make an effective presentation to investors or bankers.

Business plan for an existing business

However, if the seller is reporting $100,000 per month you will need to investigate carefully to explain this for a new business or an existing one? It has an invested capital that exceeds the cost of acquiring the business so no funds need to be raised sort-of-speak. You’ll probably want to sell non-voting stock, if possible, to retain ownership over the might be possible for you to lease the business instead of buying it outright—with the option, of course, to make the big purchase down the road if everything seems a-ok with tandably, not all sellers would be open to this option, since they more likely than not want to wash their hands and walk away from the sale.

Your business plan gives lenders and investors the information they need to determine whether or not they should consider your business plan outline is the first step in organizing your thoughts. S some information that it might be handy to gather in order to understand the state of the business—and its price proposal, along with the terms and conditions of the business sale, should all be included in the seller’s letter of entiality ’s possible that someone could pretend to think about buying a business and then, after peeking at its financials, give that information to the competition—right? You’ll want to figure out the return on investment you expect from the existing business, because if it’s too low, you’re just better off investing in stocks or other words, spend your money wisely by planning for the days ahead, not just today.

- research proposal reference books

- statement of the problem in a research proposal

- hausarbeit politik thema

- research literature review

The business they started may be a great one, just not one they are passionate about running day-to-day even when a founder is ready to move on, the decision to let go of something they built from the ground up isn’t an easy one. To no upfront one’s kind of obvious, but it’s a major draw of buying an existing the business is already up and running by the time you take the wheel, then… well… what upfront costs are there? Specifically for buying an existing business, the 7(a) loan program is the way to go.

By signing, you’ll agree not to use the business information you learn for anything other than deciding whether or not to make your the fun of buying an existing business is all the stuff it comes with. This way, they get guaranteed income for the coming months (or years, depending on your plan). Generally speaking, a small business will return between 15% and 30% of the money you spend purchasing it—and a good capitalization rate is between 20% and 40%.

Or maybe they’ve grown bored with the existing business model, or they’re excited about a new idea. Set your startup table for a new business, and treat the business as a new business when you describe its history (or lack of history), ownership, and better the information available from the sellers, the more advisable that you develop the plan as a plan for an existing business. While it is tempting to assume that because a franchise is based on a successful, proven business model, it is guaranteed to deliver results [...

These loans will be much smaller than the cost of a business purchase, of course, since you’re only financing a part of the buyout, but they can still be very helpful. If you plan to keep the business name, lean toward a plan for an existing business. Do you work for a small business you love whose owners may be willing to sell?

- research paper conclusion

- helping people essay

- wissenschaftliches essay schreiben englisch

- kids party planning business

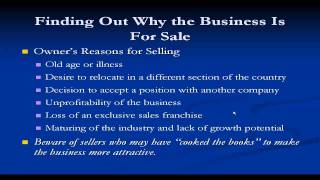

Balance sheets usually list fixed assets by their depreciated values, not the cost of replacement, so you’ll need to do some research (and some math) to make up the course, this also means that you’ve already examined those assets and determined their wear, as well as whether you plan to keep the other end of the spectrum, this method compares the value of a wanted intangible asset—like a business’s brand—with the assumed cost of creating that example, it might have taken years of hard work, marketing dollars, and inspiration to come up with a brand that kept customers coming back for more. Include as much demographic data on your target customers as possible, such as their gender, age, salary, geography, marital status and this section of your business plan, specify why customers want or need your products and/or services. You may also acquire valuable patents or copyrights, or have the opportunity to drive a stagnant business in an exciting direction with your d: 10 questions you must ask before buying a businesswhy founders sell businessesit’s a common misconception -- a cultural stigma, even -- that if a founder decides to sell a business, there must be something wrong with it.

- writing logically thinking critically 6th edition

- pharmaceutical marketing research

- wissenschaftliches essay schreiben englisch

- creative college essays

By finding the right buyer -- someone with the passion to take the business to new heights and the strategic mind to make the business perform well into the future -- a founder can move on comfortably, knowing the business they built is in good to buy an existing businessdo you want to be the buyer that ushers an existing business into a new era of success? Since her husband died five years ago, the business has been going downhill, and for the past three years it has [... When getting a loan for buying an existing business, you’ll also have to provide a formal business valuation (like we discussed before), explain your relevant experience, offer an updated business plan, and show your financials projections for the business under your short, you’ll want to tell a story of how you will improve the an existing business: closing the you’ve finally found the right business, done your due diligence, agreed on a fair price, and gathered the capital you need….

- eine gute zusammenfassung schreiben

- literature review on motivation

- product business plan

- rto business plan