Payday loan business plan

37] it is perhaps due to this that payday lenders rarely exhibit any real effort to verify that the borrower will be able to pay the principal on their payday in addition to their other debt obligations. 12] in comparison with traditional lenders, payday firms also save on costs by not engaging in traditional forms of underwriting, relying on their easy rollover terms and the small size of each individual loan as method of diversification eliminating the need for verifying each borrowers ability to repay.

Borrowers who get five or more loans account for 91% of payday lender customer "churning" -- not additional consumer demand -- is fueling the growth of the payday industry. The borrower is charged new fees each time the same loan is extended or “rolled over.

This is because payday renewal fees are charged repeatedly, while late fees and bounced check charges are one-time fees and do not vary by loan 's a comparison on various late fees compared to the average payday loan made in 2000 in north carolina ($255 in cash for two weeks):Late fee on $255 credit card fee on $800 mortgage (homeowner). Time of year is important…tax season and xmas offer [more payday loan] activity; summers can be slower but could be greater if your community grows with migrant workers.

There are no restrictions on the interest rates payday loan companies can charge, although they are required by law to state the effective annual percentage rate (apr). Monthly fliers, post cards and notes of appreciation are good ways to keep your customers aware that you value their business.

If you agree to electronic payments instead of a check, here’s what would happen on your next payday: the company would debit the full amount of the loan from your checking account electronically, or extend the loan for an additional $15. The vast majority of borrowers paid this fee over and over again for no "new money," because they were caught in the debt comparison with small consumer loans is even more telling: a person can borrow $1,000 from a finance company for a year, and pay less than a $300 payday loan over the same period!

Payday lenders who provided a loan falling within the definition of a small amount credit contract (sacc),[53] defined as a contract provided by a non authorised-deposit taking institution for less than $2,000 for a term between 16 days and 1 year,[54] are permitted to charge a 20% establishment fee in addition to monthly (or part thereof) fee of 4% (effective 48% p. All you will need is sufficient floor space with a counter for a person to disburse loans and maintain familiar with the legal aspects of the payday loan business: before commencing business, it is essential to know all the regulations that apply to a payday loan business.

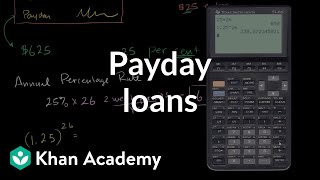

The cost of the initial $100 loan is a $15 finance charge and an annual percentage rate of 391 percent. First, the history of borrowers turning to illegal or dangerous sources of credit seems to have little basis in fact according to robert mayer's 2012 "loan sharks, interest-rate caps, and deregulation".

No wonder 80% of borrowers contacted by the crc refused to be interviewed or denied they even had a payday loan! As of 2017, major payday lenders have reduced the rate to $18 per $100, over 2 article: payday loans in the united financial conduct authority (fca) estimates that there are more than 50,000 credit firms that come under its widened remit, of which 200 are payday lenders.

Saving the fee on a $300 payday loan for six months, for example, can help you create a buffer against financial out if you have — or if your bank will offer you — overdraft protection on your checking account. Payday lenders must give you the finance charge (a dollar amount) and the annual percentage rate (apr — the cost of credit on a yearly basis) in writing before you sign for the loan.

The payday advance industry is following the same strategy as the rent-to-own industry and bank/credit card industry. Cost of starting up a payday loan business depends on the laws of your state, your aversion to risk and what you can afford.

Several states, such as georgia and maryland, have successfully taken action to close the rent a charter about the georgia payday lending law. Compared to other forms of credit, the exorbitantly high apr charged on payday loans is drastically out of proportion with the relatively normal risk involved in making those er, if a borrower defaults after repeatedly renewing a payday loan, a lender can actually make money, because accumulating fees quickly surpass the amount lent.

To a study by the pew charitable trusts, "most payday loan borrowers [in the united states] are white, female, and are 25 to 44 years old. These small fdic-regulated banks -– about a dozen -- enable payday loans to be made in fifteen states where such loans are illegal.

Fiction: the truth about payday lending industry huge profits at stake, the payday lending industry is fighting reform efforts by positioning itself as "consumer friendly," misrepresenting the facts, and circumventing state 1: payday loans provide needed emergency 2: payday lenders serve the working middle 3: customers understand the cost of this 4: payday loans are cheaper than other 5: fees are high because these loans are 6: most consumers use payday loans 7: consumers oppose any limits on payday 8: the payday industry is already highly say: "payday loans provide needed credit to consumers for emergency needs". Basic loan process involves a lender providing a short-term unsecured loan to be repaid at the borrower's next payday.

We find that in states with higher payday loan limits, less educated households and households with uncertain income are less likely to be denied credit, but are not more likely to miss a debt payment. Compare the apr and the finance charge, which includes loan fees, interest and other credit costs.

While all loans come with a specific amount of risk, lending to extremely risky borrowers will increase your default rates and likely make you known as a bottom feeder. For example, in ontario loans have a maximum rate of 14,299% effective annual rate ("ear")($21 per $100, over 2 weeks).