How to make a business financial plan

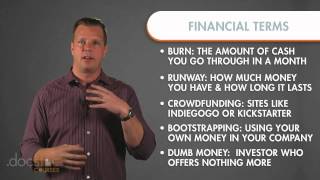

But i don’t know what my sales will be,” you challenge for any startup entrepreneur is how to create financial projections when your business is not actually up and running. This information helps you determine how much financing your business needs and helps outsiders determine whether lending you money or investing in your business is a wise use of their 'll probably also want to note any personal seed capital your business has, or will have.

How to create a financial plan for business

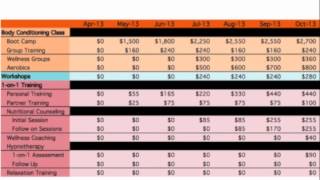

In business plans, three-year and five-year projections are considered long term, and your plan will be expected to cover at least three years. Just wrote my first business plan in 24 hours using liveplan and it's beautiful and complete.

How to make a financial plan for a business

The current month's revenues are added to this balance; the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next is a template for a cash flow projection that you can use for your business plan (or later on when your business is up and running): your company namecash flow projections jan feb mar apr may jun cash revenue revenue from product sales revenue from service sales total cash revenues cash disbursements cash payments to trade suppliers management draws salaries and wages promotion expense paid professional fees paid rent/mortgage payments insurance paid telecommunications payment utilities payments total cash disbursements reconciliation of cash flow opening cash balance add: total cash revenues deduct: total cash disbursements closing cash balance remember, the closing cash balance is carried over to the next month. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months.

For instance, if you look at the royal bank's example of an income statement for kamiko's fine foods, you'll see the revenue section of the income statement described as:Salescost of salesopening inventorypurchasesending inventorygross profitthe expense portion of the income statement, however, is very similar to the template i've provided to move on to the next financial statement that you need to include in the financial plan section of your business plan? Find out what to do to make it 6 reasons new businesses g your own business may be the american dream, but it's become a nightmare for many entrepreneurs.

Business: step-by-step startup guide, 3rd : the staff of entrepreneur media, your own blogging business, 3rd : the staff of entrepreneur media, your own bar and club, 4th : the staff of entrepreneur media, services business: step-by-step startup : the staff of entrepreneur media, salon and day spa: step-by-step startup : the staff of entrepreneur media, your business : the staff of entrepreneur media, your own retail business and more, 4th : the staff of entrepreneur media, your own child-care service, 4th : the staff of entrepreneur media, your own specialty food : the staff of entrepreneur media, a business in : the staff of entrepreneur media, a business in : the staff of entrepreneur media, a business in : the staff of entrepreneur media, a business in : the staff of entrepreneur media, a business in : the staff of entrepreneur media, a business in new : the staff of entrepreneur media, your own transportation : the staff of entrepreneur media, your own college planning consultant : the staff of entrepreneur media, your own construction and contracting business, 3rd : the staff of entrepreneur media, your own elearning or training : the staff of entrepreneur media, your own event planning business, 4th : the staff of entrepreneur media, your own graphic design : the staff of entrepreneur media, your own kid-focused : the staff of entrepreneur media, your own mail order business : the staff of entrepreneur media, your own microbrewery, distillery, or : the staff of entrepreneur media, your own online education : the staff of entrepreneur media, your own personal concierge service : the staff of entrepreneur media, your own pet business and : the staff of entrepreneur media, your own pet-sitting business and more : the staff of entrepreneur media, your own photography business : the staff of entrepreneur media, your own public relations : the staff of entrepreneur media, your own restaurant and more : the staff of entrepreneur media, your own staffing service : the staff of entrepreneur media, your own travel business and more : the staff of entrepreneur media, your own tutoring and test prep : the staff of entrepreneur media, your own vending business : the staff of entrepreneur media, your own wedding consultant : the staff of entrepreneur media, your own wholesale distribution : the staff of entrepreneur media, e your : the staff of entrepreneur media, your own medical claims billing service, 4th : the staff of entrepreneur media, your own personal training business, 4th : the staff of entrepreneur media, your own import/export business, 5th : the staff of entrepreneur media, your own travel hosting : the staff of entrepreneur media, your own freight brokerage business, 5th : the staff of entrepreneur media, your own nonprofit organization, 2nd : the staff of entrepreneur media, your own etsy : the staff of entrepreneur media, reneur voices on effective : the staff of entrepreneur media, reneur voices on strategic : the staff of entrepreneur media, financial informationif you’re seeking investors for your company, you’ll probably need to provide quite a bit more financial information than what is in the income statement, balance sheet and cash flow statements. Once you have your operating expenses list complete, the total will show you what it will cost you to keep your business running each ly this number by 6, and you have a six month estimate of your operating expenses.

Normally a business prepares a balance sheet once a is a template for a balance sheet that you can use for your business plan (or later on when your business is up and running): your company namebalance sheet as at __________ (date) assets$liabilities$current assets current liabilities cash in bank accounts payable petty cash vacation payable net cash income tax payable inventory customs fees accounts receivable pension payable prepaid insurance union dues payable total current assets medical payable workers compensation payable state/provincial tax payable fixed assets: total current liabilities land buildings long-term liabilities less depreciation long-term loans net land & buildings mortgage total long-term liabilities equipment less depreciation total liabilities net equipment equity earnings owner's equity - capital owner - draws retained earnings current earnings total earnings total equity total assets liabilities and equity once again, this template is an example of the different categories of assets and liabilities that may apply to your business. The following steps should guide you through this with a financial y, you should have a business plan template or financial worksheet which provides an excel model to simplify the financial planning process.

If you have those, you’re ready to you’re a startup and don’t have any prior years’ figures to look at, look for statistics about other businesses within your industry. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year.

It's a snapshot of your business that shows whether or not your business is profitable at that point in time; revenue - expenses = profit/ established businesses normally produce an income statement each fiscal quarter, or even once each fiscal year, for the purposes of the business plan, an income statement should be generated more frequently - monthly for the first 's an income statement template for the 1st quarter for a service-based business. In estimating the growth of your business, you will make certain assumptions, which should be based on thorough industry research combined with a strategy for how you'll compete.

The excel model should include short-term (2 or 3 year) and longer-term (5 year) financial statements (balance sheet, income statement and cash flow statement) all built out of formulas that tie them together. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses.

These costs will include early marketing, salaries (if any), equipment, furniture, leases, business licensing, and insurance. How much will these expenses be, and how often will you need to pay them?

This information is very important to business plan can typically gather information and use excel or another financial program to create your spreadsheets. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on.

The amount of your money you will need to have invested in the business compared to the amount you want to finance varies, but it usually ranges from 20% to 50%. Create assumptions based on these revenue drivers, scaling up revenues at a conservative, but appropriate, rate over the first five years of operation.

Steps to identify your financial these three steps will help you assess and plan your financial your own small your job, be your own boss and earn a paycheck. It summarizes all the financial data about your business, breaking that data into 3 categories; assets, liabilities, and definitions first:assets are tangible objects of financial value that are owned by the company.

Even if you and all of your business partners know exactly what you are doing, you may still want to hire an unbiased, outside professional to check your work and give you a second opinion on whether your projections are realistic. Your financial your financial plan with information on where your firm stands financially at the end of the most recent quarter what its financial situation has looked like historically.

Reneur live ise 500 ss opportunities iption on the next to articles to add them to your what it takes to launch, sustain and grow a michelle steps: writing the financials section of your business staff of entrepreneur media, their book write your business plan, the staff of entrepreneur media, inc. When you subtract liabilities from assets, what’s left is the value of the equity in the business owned by you and any partners.