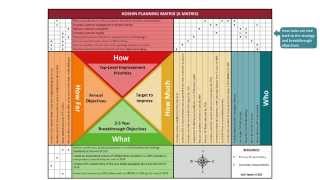

Business plan matrix

This is likely to be an area of business that is quite competitive, where the pioneers take the risks in the hope of securing good early distribution arrangements, image, reputation and market share. Anyone can run their own business or be successful in self-employment given the simple determination to do so. Having not enough money to pay taxes because you've under-estimated tax due is a problem; sometimes enough to kill an otherwise promising 's an example to show how quickly and easily you can plan and set aside a contingency to pay your tax bills, even if you've no experience or systems to calculate them precisely.

Concise business plan

Growth, legislation, seasonality, pest factors where relevant, refer to ansoff matrix, show the strategic business drivers within sector and segments, purchasing mechanisms, processes, restrictions - what are the factors that determine customers' priorities and needs - this is a logical place to refer to ethics and csr (corporate social responsibilityexplain your existing business - your current business according to sector, products/services, quantities, values, distributor, e your existing customer spread by customer type, values and products/services including major accounts (the 'pareto principle' or the '80:20 rule' often applies here, eg. But, there's no reason why you can't start crafting your business plan ad our business plan templates and financial tables to help you get ss plan pack (pdf, 1mb). If significantly relevant to achieving the marketing plan pragmatic - marketing plans vary enormously depending on the type, size and maturity of business.

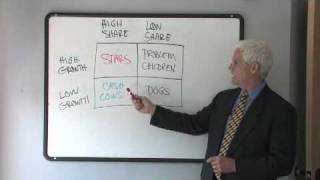

Third crucial requirement for business plans is return on investment, or for public services and non-profit organisations: effective use of investment and resources, which is beyond simple 'cost control'. Good productsnot so good productsgood customersdevelop and find more customers like these - allocate your best resources to these existing customers and to prospective customers matching this profileeducate and convert these customers to good products if beneficial to them, failing which, maintain customers via account managementnot so good customersinvest cautiously to develop and improve relationship, failing which, maintain customers via account managementassess feasibility of moving these customers left or up, failing which, withdraw from supplying sensitivelyassessing product type is helped by reference to the boston matrix model. When faced with business planning or strategy development task it's important to clarify exactly what is required: clarify what needs to be done rather than assume the aim from the description given to it - terms are confused and mean different things to different people.

Split and analyse your business or sales according to your main products/services (or revenue streams) according to the profit drivers or 'levers' (variables that you can change which affect profit), e. Meanwhile here is useful information about limited company (plc) - not appropriate for small -trader and partnership companies are very easy to set up and administer, but the owner/partners are personally liable for all business debts and potential claims, so good insurance cover (including professional indemnity and public liability) is essential especially if business liabilities are potentially serious. Add these percentages together, and then set aside this percentage of all your earnings that you receive into your business.

Once established it can be quite difficult to unravel and change if you get it wrong - not impossible, but a nuisance if you could have got it right first time with a bit of extra thought at the planning stage. Service-offer or proposition should be an encapsulation of what you do best, that you do better than your competitors (or that they don't do at all); something that fits with your business objectives, stated in terms that will make your customers think ‘yes, that means something to me and i think it could be good for my business (and therefore good for me also as a buyer or sponsor). It is very difficult to introduce ethical principles later into an enterprise, especially when planning shifts into implementation, and more so if problems arise relating to integrity, honesty, corporate responsibility, trust, governance, etc.

The main advantages of vat registration are:your business will be perceived by certain people - especially other businesses - to be larger and more credible (not being registered for vat indicates immediately that your turnover is below the vat threshold)you will be able to reclaim vat that you are charged on legitimate allowable business coststhe main disadvantages of being vat registered are:the administrative burden in keeping vat records and submitting vat returns (although this has been enormously simplified in recent years so that for small simple businesses it is really not a problem at all)risks of getting onto cashflow difficulties if you fail to set funds aside to pay your vat bills (see the tax tips below)information about vat (and all other tax issues) is at the uk government hm revenue and customs website: http:// is not the only tax. It is flexible according to the type of enterprise, its main purpose and a conventional profit-driven corporation return on investment (at an optimal rate) is typically a strong strategic driver for local planning and decisions, and by implication also a basic requirement of the enterprise as a whole. On the other hand, in a business or organization less focused on shareholder reward, such as a public services trust or charity, or a social enterprise or cooperative, return on investment (at a relatively lower rate), may be a requirement simply to sustain viable operations, according to the aims of the enterprise.

In other words, what is the business aiming to do over the next one, three and five years? In many cases, where business planning is a continuation of an ongoing situation, the most frightening spreadsheets can provide a very easy template for future plans, especially with a little help from a colleague in the acciounts department who understands how it all ally, a blank sheet of paper - in other words a 'new business start-up' - is usually a much more challenging starting is generally more difficult to write a business plan for a start-up business (a new business) than for an existing is because an existing business usually has computerised records of the results of past activities and trading (usually called 'accounts'). Its results you have to choose one of the three following roads:Have to go back because there is something wrong in to write a business plan dissertation:It in using the above tools.

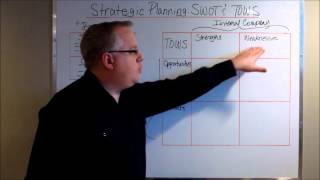

In recent years, with the majority of these funds supporting the creation and updates of online training and certification for score topicsbusiness ed webinar how to develop a business plan in six easy 5, 2014, 1:00pm edt this webinar will give you pragmatic, straightforward tools for setting goals, developing action plans for achieving them, measuring how you are doing on an ongoing basis and adjus read te business planning & financial statements template tools can be your first step towards small business success. This example is based on a self-employed consultancy-type business, like a training or coaching business, in which there are no significant costs of sales (products or services bought in) or overheads, i. As you prepare for planning, make sure all participants understand what’s involved in the process and have received any relevant information prior to of a strategic gic business plan fit strategic plan strategic plan strategic planning gic marketing plan media strategy plan analysis strategy -page strategic planning gic vision sity strategic plan a comprehensive strategic plan with of a strategic way to think about strategic planning is that it identifies any gaps between a current state and desired future state, and then dictates how to close those gaps - how to get you from where you are to where you want to be.

And viewssuccess storiescontact lp for young peopletools and resourcesbusiness you’re thinking about setting up your own company, getting your business plan right is crucial. This is because bigger sales and profits and earnings inevitably produce bigger tax bills (percentage of tax increases too in the early growth of a business), all of which becomes a very big problem if you've no funds to pay taxes when risks of getting into difficulties can be greater for the self-employed and small partnerships which perhaps do not have great financial knowledge and experience, than for larger limited company start-ups which tend to have more systems and support in financial -ups are especially prone to tax surprises because the first set of tax bills can commonly be delayed, and if you fail to account properly for all taxes due then obviously you increase the chances of spending more than you should do, resulting in not having adequate funds to cover the payments when they are are increased further if you are new to self-employment, previously having been employed and accustomed to receiving a regular salary on which all taxes have already been deducted, in other words 'net' of tax. Can you please provide an example of what you would put under “business model in your onepage u please share some format for a lot for this article.

The pitch format gets all of the critical information that you need to define the strategy for your business. Business plans written at business unit or departmental level do not generally include financial data outside the department concerned. Clearly this benefit represents a competitive advantage over other suppliers who only open principle, although a little old-fashioned today, still broadly important thing is to understand your services and proposition in terms that your customer will recognise as being relevant and beneficial to businesses have a very poor understanding of what their customers value most in the relationship, so ensure you discover this in the research stage, and reflect it in your stated product or service proposition(s).