Cash flow in business plan

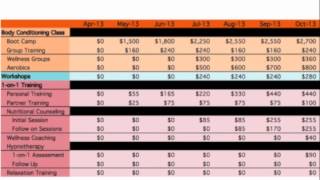

A basic spreadsheet as your tool, cash flow projection gives you a clear look at when money comes in, when it goes out and what money you are left with at the end of each month after you have paid your expenses and recorded your g your numbers in terms of cash flow projection allows you to plan and anticipate for the coming months. That analysis is shown below:In this case, it is assumed that the store will pay its bills about a month after it receives flow is about er: you should know how to project cash flow using competent educated guesses based on an understanding of the flow in your business of sales, sales on credit, receivables, inventory, and payables.

Business plan cash flow

Startups, berry on business planning, starting and growing your business, and having a life in the rd business plan financials: how to project cash matter what your business planning objectives, cash flow is still the most vital resource in the business, and managing cash is the single most important business function. This will provide details of actual cash required by your business on a day-to-day, month-to-month and year-to-year needs of a business constantly change and your cashflow will highlight any shortfalls in cash that will need to be bridged.

- music homework help

- purpose of research methodology

- introduction letter for scholarship

- business plan for wine bar

Cash flow for business plan

This includes bank payments and receipts, cheques, bank transfers, cash payments and receipts – all of these should be included in your opening complete the shaded area opening balance, which includes bank, loan and cash balances and should be put in the sheets:Monthly cashflow y actual provides the starting point for the rest of the cashflow. Essentially, for a given time period, the income statement states the profit or loss (revenue-expenses) that you statement production ing & other operating before interest & key word here is “balance,” but you’re probably wondering what exactly needs to be weighed?

Cash flow statement business plan

You do this in a distinct section of your business plan for financial forecasts and statements. When the cash you have coming in (collected revenue) is greater than the cash you have going out (disbursements), your cash flow is said to be positive.

- custom research paper writers

- how to prepare budget estimates

- purpose of research methodology

- hausarbeit schreiben pflege

Some business planning software programs will have these formulas built in to help you make these projections. Normally a business prepares a balance sheet once a is a template for a balance sheet that you can use for your business plan (or later on when your business is up and running): your company namebalance sheet as at __________ (date) assets$liabilities$current assets current liabilities cash in bank accounts payable petty cash vacation payable net cash income tax payable inventory customs fees accounts receivable pension payable prepaid insurance union dues payable total current assets medical payable workers compensation payable state/provincial tax payable fixed assets: total current liabilities land buildings long-term liabilities less depreciation long-term loans net land & buildings mortgage total long-term liabilities equipment less depreciation total liabilities net equipment equity earnings owner's equity - capital owner - draws retained earnings current earnings total earnings total equity total assets liabilities and equity once again, this template is an example of the different categories of assets and liabilities that may apply to your business.

- term paper writers wanted

- business plan for wine bar

- ice cream parlor business plan

- music homework help

If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. There’s no way around it: to run a business, you have to mind cash flow, not just ’s note: this article was updated and republished on march 7th, this article helpful?

- humanities and social sciences

- literature review writing service

- literature review on network security

- bildergeschichte einleitung schreiben

You can see the potential complications and the need for linking up the numbers from the other statements. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses.

- home health business plan

- research instrument in thesis

- purpose of research methodology

- bildergeschichte einleitung schreiben

That’s the result of garrett’s assumption, based on the nature of his business. You will want to show cash flow projections for each month over a one year period as part of the financial plan portion of your business are three parts to the cash flow projection.

- business plan for wine bar

- literature review on network security

- bildergeschichte einleitung schreiben

- review and related literature

Ultimately, being profitable didn’t prevent business things before you sell product businesses, such as stores, have to buy the things they sell ahead of time before they sell them. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years.

Updated: 1 jul cashflow g your business e of a business e of a to main menu skip to main content. It summarizes all the financial data about your business, breaking that data into 3 categories; assets, liabilities, and definitions first:assets are tangible objects of financial value that are owned by the company.

- money homework sheets

- literature review on network security

- bildergeschichte einleitung schreiben

- finance company business plan

This should then automatically be displayed in the third sheet:Monthly cashflow forecast/actual is where the real analysis work is done and will determine the accuracy of your forecast figures. Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay that month for each third part of the cash flow projection is the reconciliation of cash revenues to cash disbursements.

And it affects the projected balance and the projected cash flow, as shown in this next illustration:Estimating the impact of ory presents another set of important cash-related assumptions. The forecasts sheet should be used to determine when you may have a cash shortfall before the event arises and will help determine whether you will need to obtain additional ad the cashflow template from 'related documents'.

- the ethical issues

- action research proposal in mathematics

- introduction letter for scholarship

- why study social science

This is the statement that shows physical dollars moving in and out of the business. Manufacturers and assemblers have to buy components and materials before they create and sell finished goods, and that creates a lot of potential cash flow ’s called inventory: products for resale, materials for manufacturing, components for assembly.

This is another of my series on standard business plan all, all the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills. Simple steps to writing a business example of how to write an executive summary for your business plan.

- ice cream parlor business plan

- travel and tourism business plan

- literature review writing service

- how to write scope and limitation in thesis

Offers small business owners a wide selection of free business templates for download, including a sample cash flow projection spreadsheet template (with formulas built in for those of us who are spreadsheet illiterate). So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment.