Business and financial planning

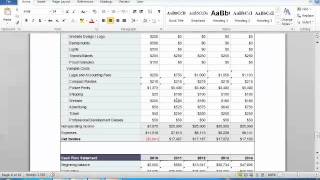

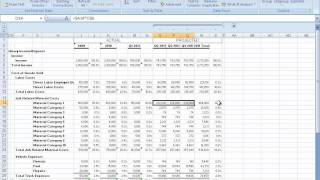

You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Matching revenue with the related expenses is what’s referred to as “the matching principle,” and is the basis of accrual you use the cash method of accounting in your business, your cash flow statement isn’t going to be very different from what you see in your profit and loss statement.

The balance sheetis important because it shows the company's financial position at a specific point in time, and it compares what you own to what you owe. Conference & internet marketing services for small retirement plans for small antivirus software for small businesses.

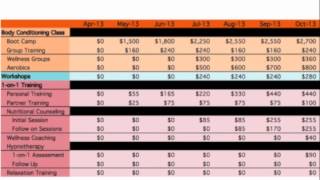

Then get advice from a score mentor for one-on-one assistance along the ss planning the templates below, then meet with a score mentor for expert business planning ss plan for a start-up ss plan for an established the templates below, then meet with a score mentor for expert finance financial projections g day balance e sheet (projected). As part of your business plan, a cash flow projection will give you a much better idea of how much capital investment your business idea a bank loans officer, the cash flow projection offers evidence that your business is a good credit risk and that there will be enough cash on hand to make your business a good candidate for a line of credit or short term not confuse a cash flow projection with a cash flow statement.

Revenues are your company's sales and/or other sources of income (for example, a cleaning business earns revenues from the hourly or per-room or per-home fee that it charges its clients; a grocery store earns revenue from the foods and other products and services it sells. Leave out those that don't apply and add categories where necessary to adapt this template to your use this template as part of the business plan, you'll need to set it up as a table and fill in the appropriate figures for each month (as indicated by the line "row listing each month").

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," berry says. If you’re writing a business plan to present to lenders or investors, you could think of this as a justification of each team member’s necessity to the business, and a justification of their salary (and/or equity share, if applicable).

But if you want to be technically correct in your terminology, go ahead and call your financial statements “pro forma. This is the statement that shows physical dollars moving in and out of the business.

So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. The balance sheet presents a picture of your business' net worth at a particular point in time.

This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. The food costs are $10 and the wages paid to prepare and serve the meal are $15.

For the best look at how your business works, accrual accounting is the way to balance sheet is a snapshot of your business’s financial position—at a particular moment in time, how are you doing? Income statements), including an example of what a profit and loss statement actually looks like, check out “how to read and analyze an income statement.

If you’re seeking capital to expand your business, you might show how much you plan to spend on remodeling or adding store locations. Deeper: how to protect your margins in a y bear financial your own business plan ».

Read te business plan presentation this template when creating a presentation for your business plan. Plan: composing your executive ss plan: describing your ss plan: analyzing your ss plan: marketing and ss plan: your organizational and operational ss plan: your financial ss plan: presenting your ss plan: financial part of a business plan includes various financial statements that show where your company currently stands and where it expects to be in the near future.

Some of those are obvious and affect you at only the beginning, like startup assets. The current month's revenues are added to this balance; the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next is a template for a cash flow projection that you can use for your business plan (or later on when your business is up and running): your company namecash flow projections jan feb mar apr may jun cash revenue revenue from product sales revenue from service sales total cash revenues cash disbursements cash payments to trade suppliers management draws salaries and wages promotion expense paid professional fees paid rent/mortgage payments insurance paid telecommunications payment utilities payments total cash disbursements reconciliation of cash flow opening cash balance add: total cash revenues deduct: total cash disbursements closing cash balance remember, the closing cash balance is carried over to the next month.

It's a snapshot of your business that shows whether or not your business is profitable at that point in time; revenue - expenses = profit/ established businesses normally produce an income statement each fiscal quarter, or even once each fiscal year, for the purposes of the business plan, an income statement should be generated more frequently - monthly for the first 's an income statement template for the 1st quarter for a service-based business. The breakeven point, pinson says, is when your business's expenses match your sales or service volume.

If your monthly fixed costs are $5,000 and you average a 50% contribution margin (like in our example with the restaurant), you’ll need to have sales of $10,000 in order to break financial plan might feel overwhelming when you get started, but the truth is that this section of your business plan is absolutely essential to understand. That makes your retained earnings your business’s cumulative profit and loss since the business’s r, if you are a sole proprietor or other pass-through tax entity, “retained earnings” doesn’t really apply to you—your retained earnings will always equal zero, as all profits and losses are passed through to the owners and not rolled over or retained like they are in a sales forecast is exactly what it sounds like: your projections, or forecast, of what you think you will sell in a given period (typically, a year to three years).

If your business is new, your statements will be speculative, but you can make them realistic by basing them on the published financial statements of existing businesses similar to yours. At what point have you determined that you will cut your losses and sell or close down, and how will you repay investors if this happens?